Welcome to the South African Wedding Costs Survey Results Presentation brought to you by by Genius Level. This survey is a comprehensive overview of the average wedding costs incurred by a couple in preparation for their wedding day.

Disclaimer: The results of this survey represent the views of the individuals who participated in this survey. Much thanks to Mzanzi Humor page for assisting in distributing the survey to their many followers. In our view our sample size is sufficient enough to warrant statistical analysis.

Planning to get married soon or in a few years? Well based on our survey results you in for a long long saving journey. I myself have started putting my cents together and with the uncertainty of how much weddings costs on average – I then decided, who better to give me some guidance on what to expect then people who have gone through the process. Well the married people have spoken and results are looking pretty heavy, or maybe I’m just broke.

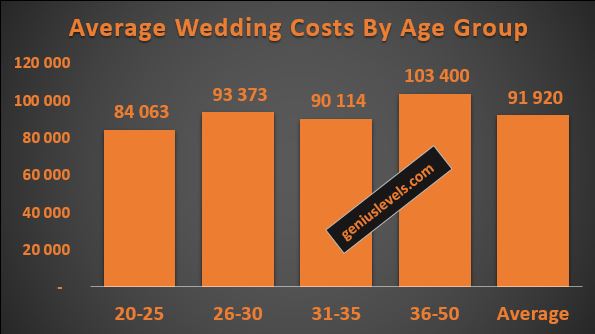

Survey participants on average incurred R90K rounded off on their wedding costs. Split up into age groups we see that 20 to 25 year olds incur on average R85K and 36 to 50 years olds cough up around R100K. Looking on earnings potential correlated with age and experience – it makes sense that the much younger age group budgeted less vs the older age group.

Its no secret that African on average pay more on wedding costs compared to other races. for more on this, I wrote an article some years back titled ‘Married In Community Of Debt’ – Why the Black Man Will Forever Be Broke

We dug further and broke down the average wedding costs by Tribe. On average the Zulu, Xhosa and Tsonga tribes spend over R100K for their weddings, right at the bottom is Venda and Swati tribes who on average spend just below R70K.

Normal everyday South Africans know that money does not grow on trees, the use of credit is constantly on the rise with Varsity fees, car payments and many other expenses breaking the pocket. Then how do these people manage to afford weddings???

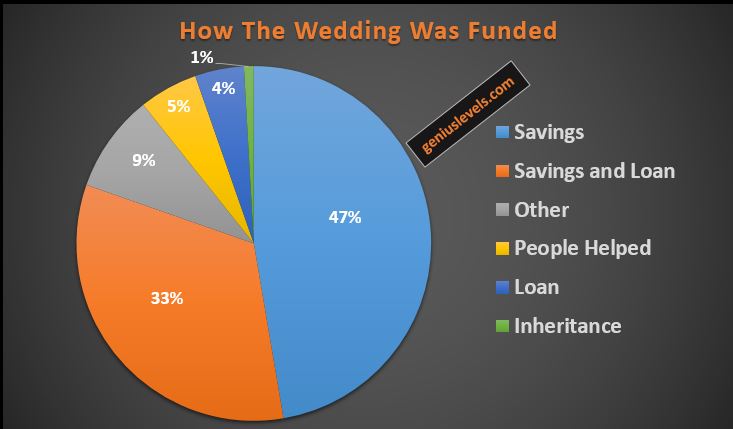

From the survey results we can deduce that just below 50% of South Africans save up for their wedding. 33% fund the wedding with a combination of savings and debt and 4% go at at it purely using debt.

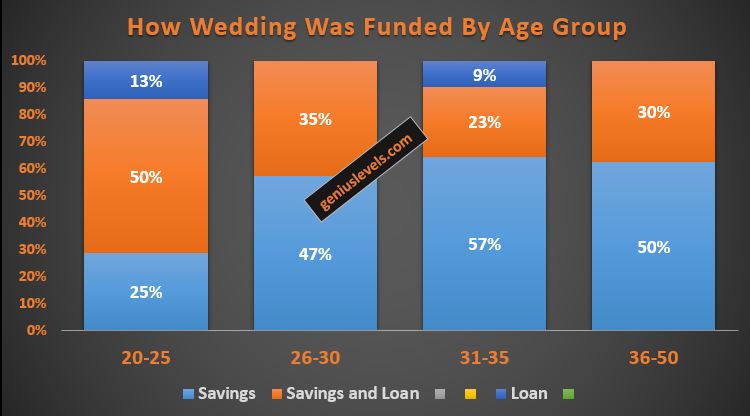

We then broke down the funding by age group – interesting enough we see that the more higher up you move in terms of age groups the more you prone to fund the wedding purely through savings – don’t rush it. Another finding is, if you decide to marry young – you more prone to fund the wedding through debt.

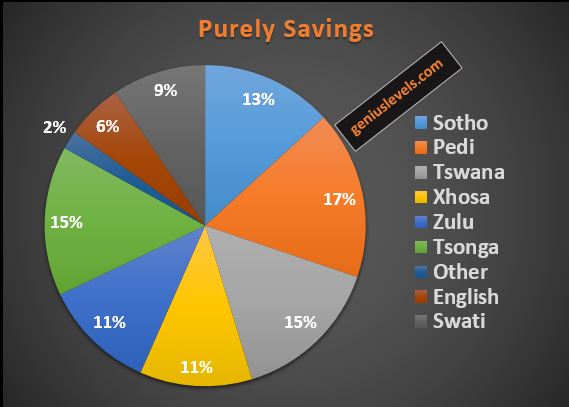

We went another step down and broke down the savings part of the results by tribe. Seems Bo Warra are good at saving, of the participants that funded their wedding purely through savings – 17% of those are Pedi, 15% Tsonga, 15% Swati and 13% Sotho.

Looking at the above stats, we can deduce that the perfect month to get married is January and July – while the worst months to get married in, in terms of costs is March and August.

Our final graph shows us average wedding costs broken down by the province the wedding was held by. Looking to marry on a budget? North West, Free State and the Western Cape should be a safe haven with wedding costs on average being lower than other provinces.

Gauteng, KZN and the Eastern Cape on average are the highest in terms of wedding costs.

In the survey we asked our participants to give advise to a young couple that’s planning on getting married – below are some of the comments that stood out.

-Plan accordingly, stick to the budget and saving money by opening a joint account.

-Don’t waste money on Wedding, just invest on your Marriage. Go to court and sign out of community And Deposits A new House with you money. Take and Travel for A month.

-Do what you can also afford. Avoid taking loans to please people you mostly don’t even know.

-Save Save Save!!!!

-Avoid credit. Jointly save up for the wedding. It’s a good feeling waking up the next of the wedding knowing you don’t have wedding debt and your life is on to a beautiful start

-Plan, get quotes. Save together.

-Keep it nice but simple

-Never take a loan to fund a wedding

-Use ur savings. And remember you still have to live after ur wedding day. Rather use the money to get a house you can move into. So u can have space and a good investment.

-Save save save and don’t do it if you don’t have enough money

-Set a budget, make monthly payments to service providers as you build up to the day. Try make sure everything is paid off before the day…that way you are not stressed on the day about starting a new life with you partner with debt.

-No debt. Plan according to your means. A paid up home, quality of life far outweighs the need to spend on a day. Our culture imposes far more responsibilities to be the biggest spenders.

-Cash is the best options. Don’t rely on people contributing and stay away from creating debt.

-Save. No matter how long it takes. It’s never a good idea to start your union in credit. SAVE

-The white wedding is not a need, but want. So you can take as long as you want to save for it.

-Plan!! Plan!! Plan!!

-Save, have your wedding during the week, invite people relevant to you

-self fund 50/50

-Start early with everything when the costs is still low

-A wedding is just a ceremony to bring two families together then starts marriage. Put all the focus on what comes after the ceremony, rather than getting into debt before you couldn’t enjoy your love

-Save money. Don’t get the loan

-Do not get married!

-Saving is the best way. Do what you can afford. There’s a life to focus on after the event.

This survey was proudly brought to you by Genius Level!!

Let Your Ideas Outlive You….

To get in-touch with us, you can drop us an email on info@geniuslevels.com

[ABTM id=6634]